Africa’s Call for Fair Financing: Will Global Lenders Respond?

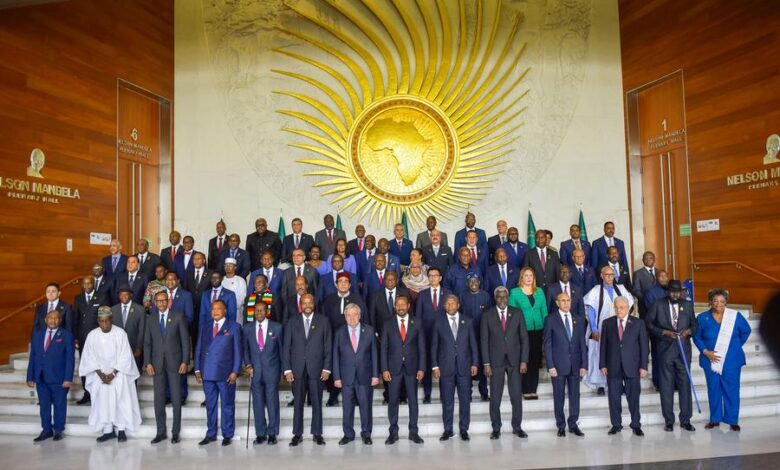

A week after African leaders made a strong case for fair financing at the 38th African Union (AU) Summit, attention now shifts to whether global lenders will take action or allow the momentum to fade into bureaucratic delays. While the summit has concluded, Africa’s pursuit of debt justice and economic sovereignty remains a pressing issue.

At the summit, African leaders issued bold demands for debt relief, framing it as a form of reparations to correct historical financial injustices. By putting global financial institutions and creditor nations under pressure, they signaled a collective resolve to change the unfair borrowing conditions that have long burdened the continent.

However, the real test lies in whether these declarations will translate into policy shifts. To drive the agenda forward, AU member states are currently working on three key proposals aimed at reforming the financial landscape.

One of these is a G20 expert panel on debt relief, led by South Africa, which seeks to push for lower borrowing costs and restructuring mechanisms tailored to Africa’s economies. Additionally, there are plans to establish an African Credit Rating Agency to challenge biased assessments by global agencies that often result in inflated borrowing costs for African nations. Furthermore, a $25 billion replenishment drive for the African Development Fund is being initiated to provide concessional financing and reduce reliance on expensive commercial loans.

Despite the optimism surrounding these initiatives, the challenge remains in securing cooperation from global financial players. As former African Union Commission (AUC) Chairperson Moussa Faki put it, “Our voices have been heard. Now, we must ensure our demands are met.”

With Africa’s leaders pushing for reforms, the coming months will reveal whether the world’s financial system is ready to embrace a more equitable approach or if Africa will once again face roadblocks on its path to economic justice.